Our Investment Team takes stock of their key themes

At a glance:

- Nutmeg's investment team is still optimistic for the rest of 2025, but acknowledge the possibility of more sharp price movements over the rest of the year.

- US stock performance has been encouraging, especially given a changeable policy backdrop. While US exceptionalism has been challenged in recent months, it is still intact as a long-term theme.

- We remain cautious over emerging markets, although we are exploring avenues for direct allocation to the Chinese technological sector.

- Increased German spending is boosting European prospects, while the UK could benefit from lower US tariffs than its European counterparts.

- We still think that US interest rates will be lowered, although trade policy and fiscal decisions could delay any decision by the Federal Reserve. In the UK, a fall in services inflation could lead to rate cuts.

- The geopolitical backdrop is a dominant theme, but we continue to prioritise investment fundamentals and careful risk management. The weakness of the dollar is a new emerging theme.

Introduction

At a little over the halfway point of 2025, our investment team have revisited the key themes they identified at the start of the year for our investment outlook. We look at which themes have unfolded as expected, where there have been surprises, and what we think investors can expect in the remainder of 2025.

Reflecting on our 2025 outlook

Start-of-year expectation: “We’re optimistic for 2025, but aware there are some challenges.”

This view has largely played out and we believe it remains accurate, but there’s a lot to unpack.

Many financial markets have shown positive performance over the first six months, despite a backdrop marked by uncertainty. This heightened level of uncertainty centred around changing trade policy induced by the announcement of unexpectedly large ‘Liberation Day’ tariffs in the US on 2 April. While these were swiftly paused, they represented the US’s largest average tariff rate since the 1930s.

This contributed to substantial bouts of volatility in equity and bond markets that saw sharp swings in asset prices, particularly in the second quarter. This was especially pronounced in April.

A scenario that we highlighted in December – which played out in the second quarter – was the potential for these bouts of volatility.

“On average a typical multi-asset portfolio that mixes bonds and equities could expect to experience periods each year in which the value falls – called a "drawdown" – even if it subsequently recovers. Investors might expect to see a peak to a trough (highest to lowest point) drawdown of about 10% for any given year. In 2024, it was only around 5%.”

Nutmeg Investment Team, December 2024

In one week in April, global equities experienced significant volatility and losses. The S&P 500 fell 12% over the week that followed Liberation Day. A multi-asset investor with a portfolio allocated 60% to global equities and 40% to global bonds would have seen a drawdown of around 10% from the high point in February, exactly in line with the long-term average that we mentioned could be expected.

Sudden falls in asset prices can cause panic, but we soon saw a strong recovery in many asset classes, with some closing out April approaching the level they started the month. There was then a sustained push higher by global markets through both May and June as volatility settled down.

The first half of the year has demonstrated that fluctuations in asset prices are a very normal part of investing. The recoveries that many markets experienced after these drawdowns demonstrate that you shouldn’t make hasty decisions during periods of market uncertainty, and instead remain focused on long-term objectives.

Mid-year view: We continue to be optimistic on the investment environment and recently shifted our equity view to ‘overweight’, meaning we are increasingly positive on the asset class. However, we do believe that uncertainty remains elevated, and further periods of sharp price movements are possible over the course of the second half of the year.

Reasons to be cheerful, and the challenges ahead

In December, we outlined the underlying challenges as well as the reasons to be cheerful that underpinned our optimistic yet cautious headline view.

Below, we look at what they were and how we see those factors now.

Reflecting on our reasons to be cheerful

December 2024 statement | Our view in July 2025 |

|---|---|

“US equity earnings continue to be better than expected. One of the key pillars of the US and, by extension, the world economy has been the resilience and strength of consumer spending.” | US equity earnings published in January for the last quarter of 2024 and in April for Q1 2025 have been spectacular. We expect that they will beat the consensus for Q2 2025, helped by a weaker dollar. |

“The general economic environment remains supportive across the world. The most prominent risk for equities in general is of a recession in the US, which seems quite remote for now.” | We continue to see the environment as supportive for the economy, particularly in the US. Earlier this year, a growing number of economists shifted their perspective delaying when they expect the next US recession to start – from 2025 to 2027 – against the backdrop of trade uncertainty. We have never considered a recession to be a likely scenario, and we keep our view that a US recession this year is very unlikely. |

“Inflation, which was a cause for concern worldwide, has significantly reduced. While it is above the pre-COVID period and above the 2% long-term target of most central banks, it is much less of a cause for concern." | Inflation has largely remained on a downward trajectory in the first part of the year in developed countries. However, we are slightly less confident on the scenario for the next six months, especially in the US where tariffs might start to add upward pressure on prices. |

Reflecting on the challenges we expected

December 2024 statement | Our view in July 2025 |

|---|---|

“US equity valuations are quite materially above the long-term average” | This has remained the case, though valuations are rarely a good indicator of short to mid-term performance. As reflected in our ‘overweight’ equity position, and positive view on the US market, we believe investing conditions remain encouraging. However, this is often accompanied by higher valuations. It is something we will continue to monitor carefully. |

“The geopolitical landscape remains uncertain globally” | In the first half of 2025 we have seen the geopolitical landscape continue to be highly uncertain. We have seen: |

“Other technical factors could have an impact, like the recent rally in the US dollar, which could further destabilise some emerging countries with liabilities in US dollars.” | The dollar has weakened this year, down between 5-10% against other currencies which isn’t something we were expecting. The world judged that tariff policies could indicate reduced global engagement by the US. However, recent geopolitical interventions from the US do not reflect this. The robust US economy and the need for dollar-based transactions around the world both suggest demand for the currency will not vanish. |

Data source: Nutmeg, Macrobond as at 15 July 2025

Key themes review

We highlighted five key themes in December that we felt would shape the investment backdrop in 2025. We reflect on these themes below, analysing how they have played out, and how we think they will progress over the remainder of the year.

Start-of-year themes and current assessment

1) US Exceptionalism – bet against it at your peril

Mid-year view: Theme intact but no outperformance

The US has been the preeminent stock market over the last decade, with the breadth and depth of investable companies outstripping peers globally. US ‘exceptionalism’ has been defined by outperformance vs. other regions, with the so-called ‘Magnificent 7’ tech companies driving a significant degree of this.

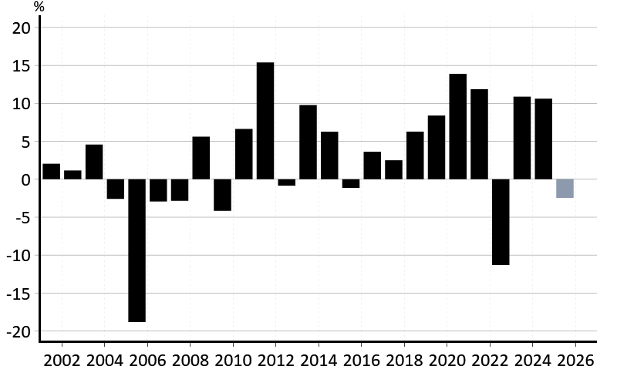

As the below chart shows, US stocks have slightly underperformed global stocks so far this year despite a good outperformance in May and June. The US has not been the top performing regional market globally, but the underperformance is relatively marginal compared to the excess returns in previous years.

Chart 1: US stocks excess performance vs. global stocks (excluding US)

Source: Macrobond and Nutmeg, Data as at 16 July 2025. MSCI USA vs. MSCI World All Country ex. USA, in local currency. MSCI USA and MSCI World All Country ex. US are both examples of indexes/indices. An index is a group or basket of securities, derivatives, or other financial instruments that represents and measures the performance of a specific market.

Looking forward

Stocks in a handful of other regions, such as Europe and the UK, have outperformed the US so far in 2025. But US stock performance has been encouraging, especially given the turbulent policy backdrop. We believe that, while US exceptionalism has been challenged in recent months, it is still intact as a long-term theme.

As mentioned earlier, we have seen the US dollar weaken somewhat, but the US economy has proved highly resilient, with fears of US recession receding. A weaker US dollar may, in fact, help US companies and their profit margins.

2) Tempted to allocate more to emerging markets? Tread carefully...

Mid-year view: Theme challenged

US-dollar denominated EM equities have experienced a strong first half of the year. They have been buoyed by the weakening of the US dollar and a positive impact in January from the ‘DeepSeek’ moment when a lesser-known Chinese technology company released AI functionality that could compete with US-based peers, but at a fraction of the cost.

A weaker US dollar is usually a positive factor for emerging markets, reducing the cost to service their US dollar-based debt. However, those same countries may then be less competitive in the US market. This is down to a weaker dollar making imports more expensive for US businesses and consumers. This is before considering tariffs, which can further weaken overseas competitiveness in US goods markets. As a reminder, a tariff is akin to a type of tax and is paid by a purchaser to their domestic government when importing a good.

Looking forward

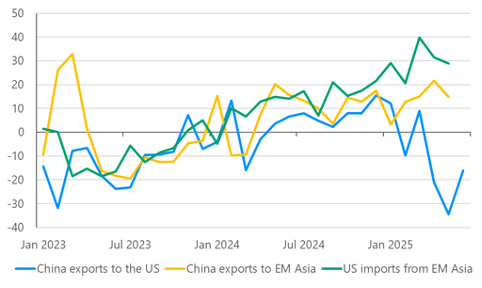

We continue to hold an ‘underweight’ position - relative to our long-term benchmark - on emerging market equities, mostly underweighting China and having a neutral view on other emerging countries. In China, while the technological sector continues to innovate, the broader macroeconomic environment faces challenges. We are seeing weak consumption activity from Chinese households, while tariffs are an obstacle for exporters. There are potentially signs that Chinese exporters are re-directing exports through other markets, as shown in the below chart.

Chart 2: Chinese exports to and US imports from EM Asia countries

Source: J.P. Morgan Asset Management’s Mid-Year Investment Outlook - June 2025, China Customs, LSEG Datastream, US Census Bureau, J.P. Morgan Asset Management. EM Asia includes Brunei, India, Indonesia, Laos, Malaysia, Philippines, Singapore, Thailand, Vietnam. Data as of 31 May 2025.

Overall, we keep this view on emerging markets and our underweight against the Chinese market as a whole. We were surprised by the ‘DeepSeek’ impact and the positive change of government supportiveness toward innovative and growth companies. We are exploring options to have direct allocation to the Chinese technological sector, which we find attractive from a valuation and innovation standpoint. We are less enthusiastic towards other sectors, which look challenged by Chinese macro-economic difficulties.

3) UK and Europe on diverging paths in 2025?

While setting out our views for the year, we noted that “the UK appears to be in a relatively better position than Europe, thanks to consumption and trade.”

Mid-year view: Theme challenged

Looking at the economic picture in the UK, growth is in a delicate position. Q1 2025 GDP came in better than expected, but inflation has proved sticky, hovering around 3.5% in the second quarter. As the narrative around tariffs continues to develop, it appears that UK goods may face lighter US tariff rates than European peers. At the time of writing, 30% tariffs have been threatened by the US on goods from the European Union. These situations can develop quickly, as shown over the course of recent months, so nothing is assured yet.

For stock markets, both regions have performed well. The UK’s FTSE 100 rose 9.5% over the first half of the year, while European stocks gained over 13%. Europe has been buoyed by Germany’s commitment to boost defence spending to 3.5% of GDP by 2029. This comes with a €500 billion infrastructure fund. This level of military spending is above any previous forecasts, with a budget containing fiscal stimulus unprecedented since the German reunification in the 1990s.

Looking forward

The shift in German policy could be a long-term game changer for the continent, with the possibility of increased dynamism. On the UK side, the potential for lower US tariffs is notable, and could be a structural benefit. However, the EU is still the UK’s largest trading partner. Taking this into account, we increased our allocation to European assets in our Fully Managed and SRI portfolios, with our industrials exposure particularly benefitting from increased defence spending and renewed European dynamism. Looking at currency, the euro has strengthened somewhat, which might start to have an impact on European exporters at some point, something that we’ll keep monitoring actively.

4) How interest rate policy could develop

“The UK and US will try to reduce base rates to as close to their 'neutral' levels as possible…We believe moderate demand and productivity growth will allow central banks to continue, in 2025, the cautious series of rate cuts they began in 2024. But the extent of easing will depend on this balance of demand strength and resultant inflationary pressures.”

The “neutral rate” is the level at which an economy can maintain price stability, i.e. inflation sits at its target, which in the UK is 2%.

Mid-year view: Theme intact in the medium term, but it could take longer to play out

In the UK, inflation was falling steadily in the first few months of the year, providing the Bank of England (BoE) with the space to cut interest rates in February by 0.25%. This was followed by another 0.25% cut in May, but the economy has since struggled to shake off a period of stickier inflation in the late spring and early summer months. In the US, rates have so far been untouched in 2025. Inflation still sits below 3% but has been creeping slightly higher in recent months. Tariffs pose an inflationary threat, and we could be starting to see some of this seep through.

Looking forward

UK inflation should show signs of improvement in the third quarter, as the energy price cap cut comes into effect for the third quarter. Even after recent events in the Middle East, petrol pump prices are down around 10% compared to a year ago. On the flip side, household finances remain under pressure as food prices continue to rise. We are closely watching how services inflation performs over the summer months to see if the recent cooling in the labour market leads to a downward pressure on prices. If services inflation levels can move closer to 4%, it could boost the chances of rate cuts in the second half of the year from the BoE.

In the US, we still see the direction of travel of interest rates being downwards. However, the trade policy uncertainty and lack of fiscal discipline creates further risk to this thesis.

5) Navigating a new political era without losing sight of long-term goals:

“A new administration in the United States, with concentrated power, introduces a degree of uncertainty compared to the more predictable Biden administration…Despite these developments, it is crucial not to become overly distracted by geopolitical events when it comes to investments.”

Mid-year view: Theme intact

As mentioned earlier, the first half of the year has been highly active geopolitically. It is understandable that investors may feel a degree of apprehension when digesting this type of news flow. However, we have again seen that this does not necessarily equate to upset in the financial markets. We believe that events in the Middle East have had a limited, albeit not insignificant, impact on markets and oil prices. This would have been almost unthinkable a few years ago.

Looking forward

There is certainly the potential for the geopolitical landscape to continue shifting as the year progresses. We will remain focused on investing fundamentals, maintain careful risk management, and continue to analyse the most relevant elements for our investment process. Trade policy developments will still be significant, with the noise around tariffs likely to remain and a pattern of deadlines and extensions becoming the new norm. The focus on corporate earnings and earnings growth potential will remain a key pillar of our analysis. We are still cautiously optimistic for the rest of the year, but as experienced in the first half of the year, the road to positive returns could be winding.

A new emerging theme

The weakness of the US dollar has been a notable development in the first half of 2025, marking its worst performance for this period since 1973. While the prevailing consensus suggests that this underperformance may persist, we believe this view is somewhat exaggerated. Since the Global Financial Crisis, such declines have been short-lived, with investors typically viewing short-term setbacks as opportunities to increase exposure.

Despite the dollar's recent challenges, the US economy remains robust and free from recession, while inflation is moderating, which has enabled the Federal Reserve to cut rates and bond yields to fall. These conditions imply that sustained downward pressure on the dollar is unlikely. Furthermore, policy rate differentials continue to favour the dollar. In other words, base rates at other major central banks are lower than at the Federal Reserve, which makes US assets comparatively appealing on this basis. Overall, the risk-reward outlook for the dollar, both in the near and long term, appears promising.

The Nutmeg Investment Team

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not reliable indicators of future performance. We do not provide investment advice in this article. Always do your own research.