Income Investing

Unlock regular earnings while growing your wealth, with an actively managed portfolio that prioritises earning you an income.

With investment, your capital is at risk. Income isn't guaranteed and may fluctuate. £10,000 minimum investment.

What is income investing?

Using the expertise of J.P. Morgan Asset Management, investing for income focuses on generating a regular stream of income from your investments, while also growing your wealth for the future. We invest a lump sum from you into exchange-traded funds (ETFs) likely to pay dividends, and actively manage your portfolio towards delivering a monthly payout.

How could income investing work for me?

- If you have a lump sum and want to make the most of it.

- If you're already or soon-to-be retired and need to cover some living expenses.

- If your current monthly income varies and you'd like to make it more consistent.

- If you want to reduce your working hours without creating a salary gap.

How much could you make?

To give you an idea of how much income your investments could generate each month, here's an example of a risk level 1 portfolio with our latest reported yield.

The amount paid in income will not be reinvested and won't benefit from compounding.

Your lump sum investment | Monthly income from 4.9% yield |

|---|---|

£50,000 | £203 |

£100,000 | £405 |

£250,000 | £1,014 |

£500,000 | £2,027 |

£750,000 | £3,041 |

£1,000,000 | £4,055 |

Past yield and future yield figures are not a reliable indicator of future performance. Income is not guaranteed and yield can fluctuate.

Speak to us about income investing

If you're considering income investing but want to talk it through first, book a free call with our advice and guidance team. They can explain how it works in more detail, and how it could fit into your overall portfolio.

Book a free callHow income investing with us works

We build your portfolio

Using the expertise of our team and J.P. Morgan Asset Management, we create a globally diversified portfolio in line with your chosen risk level.

We manage it for you

We monitor and adjust your portfolio, and the J.P. Morgan Asset Management team actively manages the individual ETFs within your portfolio.

You receive your income

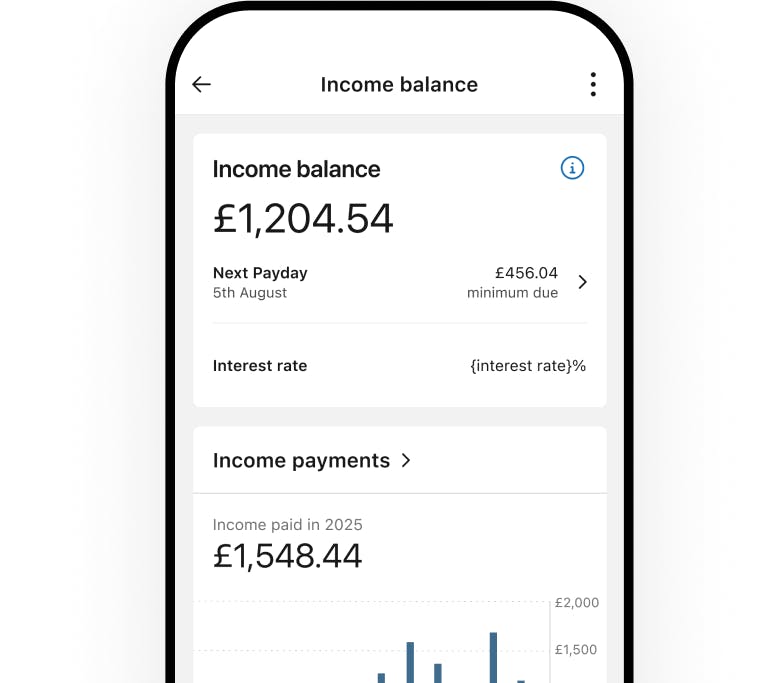

We'll pay it into your bank account monthly. If you'd like to receive a similar amount each month, switch on 'income smoothing'.

Check in or leave it to us

See where you're invested, any income due to be paid, and your portfolio's performance in your dashboard.

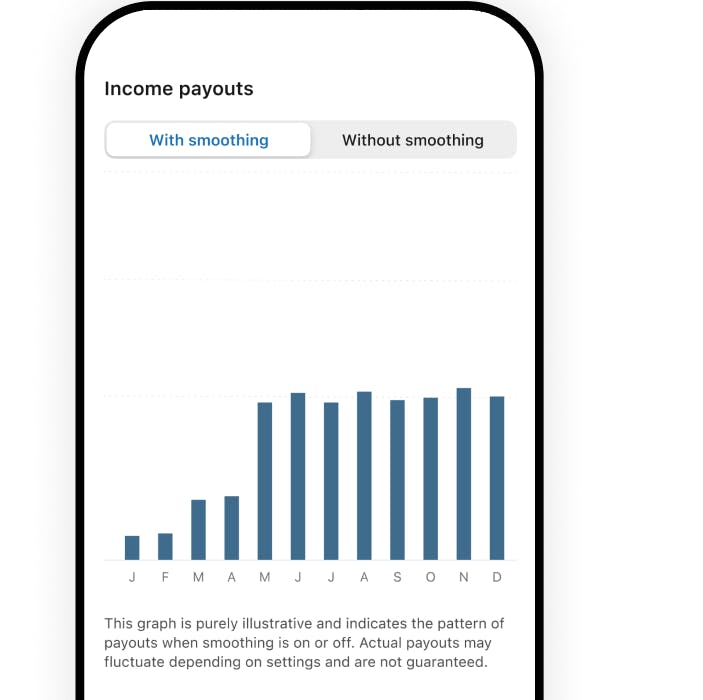

We make your payouts even smoother

It can be difficult if your income changes month to month, so we offer income smoothing to make things more consistent. The aim is to pay you a similar amount every time, and give you extra peace of mind – so you can keep the focus on your long-term future.

To do this, we set aside some of your earnings to manage the timing and spread of your payouts. The best bit? Everything we keep in reserve will also earn variable interest until it's paid out.

Our fees

We don’t charge you anything to join Nutmeg. The only fee you'll pay is for us to manage your money, plus the cost and market spread of the funds we buy into for you – no hidden surprises.

Your fees will be paid from your pots automatically each month, so there's no extra admin, and you can always check the app to see how much you're paying.

Past performance and asset allocation

Below you can see a detailed breakdown of our performance, as well as an indication of how our investments are allocated across global financial markets.

- Asset allocation

- Countries allocation

Allocation

The allocation of assets within a chosen portfolio will vary depending on your chosen risk level and investment style. Your portfolio will typically hold a large majority in equities and investing the balance in bonds to help dampen the ups and downs of the portfolio.

Capital at risk.

Choosing to invest for income or growth

Alongside income investing, we also offer portfolios purely focused on delivering long-term growth. Instead of any returns being paid out monthly, we automatically reinvest them for you to make the most of compounding – which can help your money grow faster.

Whether your focus is boosting what you have right now or building as much wealth as you can for the future, it's important to invest in a way that could bring your goals to life.

Our unique approach to income investing

For those interested in taking a closer look at our Income Investing style, our expert investment team have written this whitepaper just for you. It covers why investors might prioritise income over growth, how our approach is different, how the portfolios are constructed and how we work with J.P. Morgan Asset Management.

Latest from the investment desk

Learn more about Income Investing

In this playback of our webinar, our wealth and investment experts explain why we launched our new Income Investing strategy, the goals it may be suitable for, and the technical side of how it works.

Frequently asked questions

Is income investing right for me?

Is income investing right for me?

Income investing may be right for you if you have a primary cash flow that you want to supplement. It's likely not the right choice if it would be your only source of income – because income from investments isn't guaranteed and depends on the market. If your goal is to maximise your long-term returns, then you could be better suited to investing for growth. If you're not sure, book a free call with our advice and guidance team.

Are income portfolios actively managed?

Are income portfolios actively managed?

Yes, income investing is one of our most actively managed strategies. Our team manages how ETFs are weighted within client portfolios, and the J.P. Morgan Asset Management team manages the underlying funds – with a focus on active ETFs that aim to outperform the market benchmark.

Is there a minimum investment amount?

Is there a minimum investment amount?

Yes, you'll need to invest at least £10,000.

Is income investing available across all products?

Is income investing available across all products?

No, currently it's only available for our Stocks and Shares ISA and our General Investment Account. If you use both for income investing, you'll receive two monthly income payouts.

Do I pay tax on an income portfolio?

Do I pay tax on an income portfolio?

In an ISA, you won't pay tax on any returns. In a GIA, how much tax you pay will depend on a few factors:

- the type of returns – such as dividends or interest

- your income tax band

- any tax allowances or reliefs based on your individual situation

How will payouts work?

How will payouts work?

Providing your investments see returns, each month you'll see your income balance grow in your online dashboard or our app, as well as the income due. We'll pay any income monthly into the bank account you've verified and linked to your Nutmeg account. The exact amount will depend on whether you have income smoothing switched on or off. Any amount set aside for smoothing will be put in a cash pot, and earn a variable interest rate – but as this isn't a 'tax wrapper' like an ISA, you may pay tax on the interest.

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg, and any income from it, can go down as well as up and you may get back less than you invest. Income isn’t guaranteed. Tax rules vary by individual status and may change. Nutmeg does not provide tax advice. For personalised advice tailored to your specific situation please consult with a qualified tax adviser or financial planner.